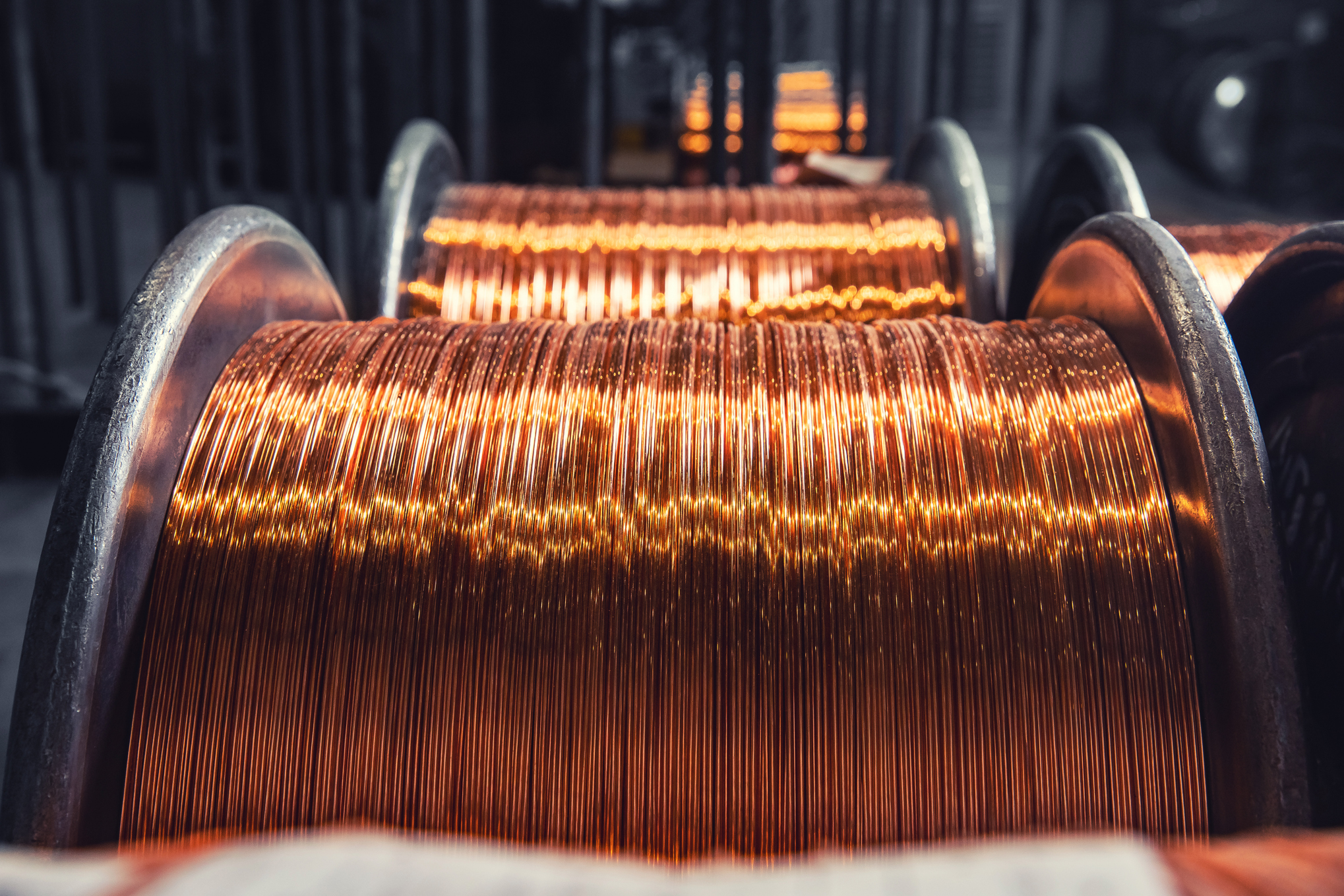

LONDON: Copper prices on Friday were set for their biggest weekly fall in a year, down around 7.5%, as investors worried that efforts by central banks to bring down inflation will stifle global economic growth and reduce demand for metals.

Other industrial metals also tumbled, with nickel down around 13% this week and tin off 25%, its biggest weekly slump since at least 2005.

“There is a risk of further losses,” said independent analyst Robin Bhar. “A sharp economic slowdown or recession seems to be on the cards.”

Benchmark copper on the London Metal Exchange was 1.4% lower at $8,290 a tonne in official trading after touching $8,220, down nearly 25% from a peak in March and the lowest level since February 2021.

Bhar said copper, used in power and construction, could fall towards its cost of production, around $7,000-$7,500, but tight supply and rising demand for use in electrification later in the decade will lift prices.

Copper drops to 16-month low as economic slowdown fears mount